“Be greedy when others are fearful, and fearful when others are greedy.”

— Warren Buffett

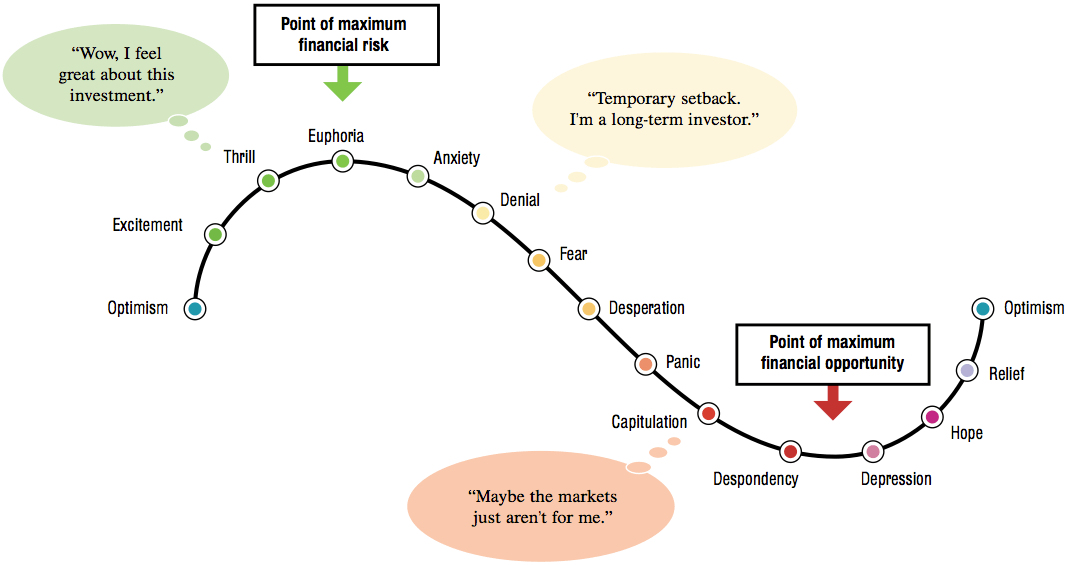

The cycle of investor emotions

This chart describes all the different emotional states typically experienced by the majority of market participants:

Investor emotion cycle, Modern Times Investors

Investor emotion cycle, Modern Times Investors

Optimism

Everything starts with a positive outlook towards the future that leads you to buy a stock.

Excitement

Markets start moving up towards your expectations and a feeling of anticipation and hope arises inside, you start to see the success.

Thrill

Market continues to go up, you are already earning and start to feel very confident of your investing decisions.

Euphoria

“You can’t miss opportunities”. Market grows, investments turn into quick and easy profits. Everyone wants to jump in: Who doesn’t want to make a ton of money risking as little as possible? The market is rising, isn’t it?

At this point, the financial risk is at it maximum, like the possible financial gain.

Anxiety

Things start to turn around, markets show the first signs of weakness but overall the sentiment for the long term is still bullish and you convince yourself that it is just a short correction.

Denial

The market correction is taking longer than you originally thought. Doubts start to arise and confidence in the long-term bull market turns into a strong hope for a short-term improvement.

Fear

At some point you have to compare your perception with the reality, maybe you haven’t been that smart. You would like to get out taking a small profit or even a small loss but you don’t act because you don’t know what to do, uncertainty is at its maximum.

Desperation

All chances of making a profit are lost at this point, you are really concerned about your investment and you strongly hope for anything that will bring our positions back into gain territory.

Panic

This is the period with the most emotional impact, where you feel helpless and really don’t know what to do, feeling without any degree of control on the situation, on your investments and on markets.

Capitulation

You sell your position at any price because you reached your breaking point. In a certain way, you are happy to get out of the stock market in order to avoid bigger losses.

Despondency

Your expectations have been disappointed, you got a strong loss from your investments, you feel bad and you don’t want to buy a stock ever again. This is the point of maximum financial opportunity for investors that are aware of what is going on and are willing to be contrarians.

Depression

This is the beginning of the aftermaths of the crash. You start thinking about what happened and ask yourself how you could have been that stupid. The key that makes the difference among investors here is if you start to look back to what happened and analyze what went wrong and start learning from from past mistakes.

Hope

Things start to gradually improve, the overall situation gets better and you realize that financial markets have cycles. You got some experience and you start to look around for new investing opportunities.

Relief

Markets are turning positive once again, you start to be faithful again and you convince yourself of your ability to invest your money. The cycle starts all over again.

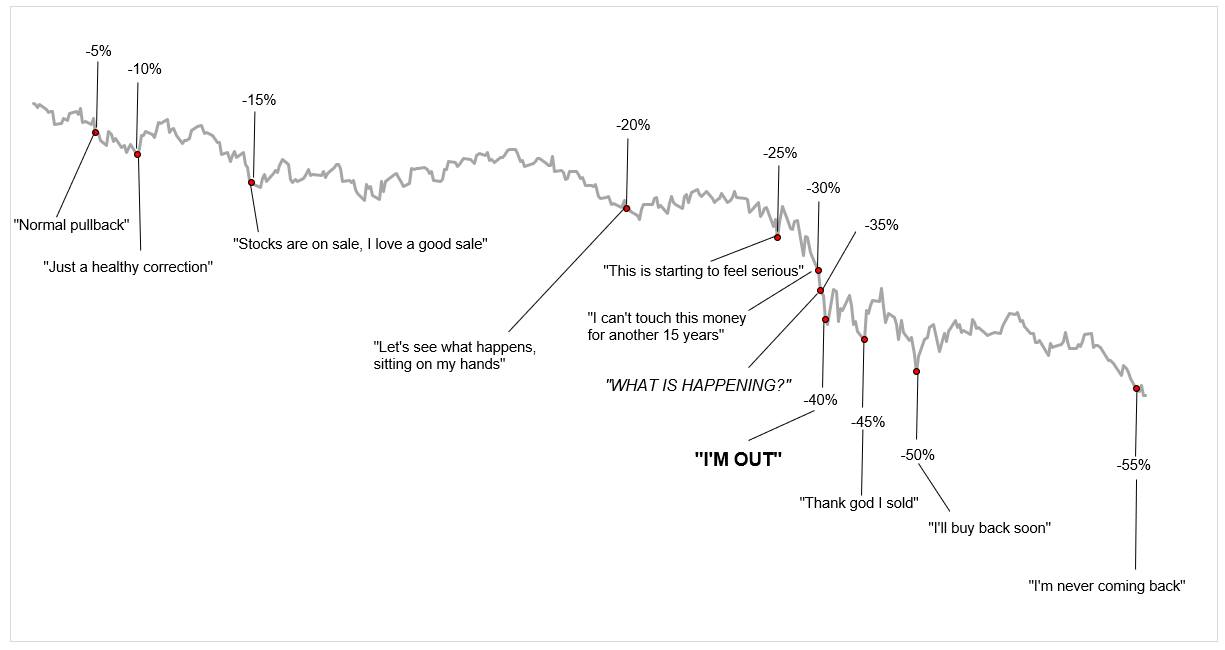

The psychology of a bear market

“Unless you can watch your stock holding decline by 50% without becoming panic-stricken, you should not be in the stock market.”

— Warren Buffett, the greatest investor of all time

Everyone has a breaking point, and it’s only in times of distress that we learn where that point is. The psychology of a bear market goes something like this:

The psychology of a bear market, Michael Batnick

The psychology of a bear market, Michael Batnick

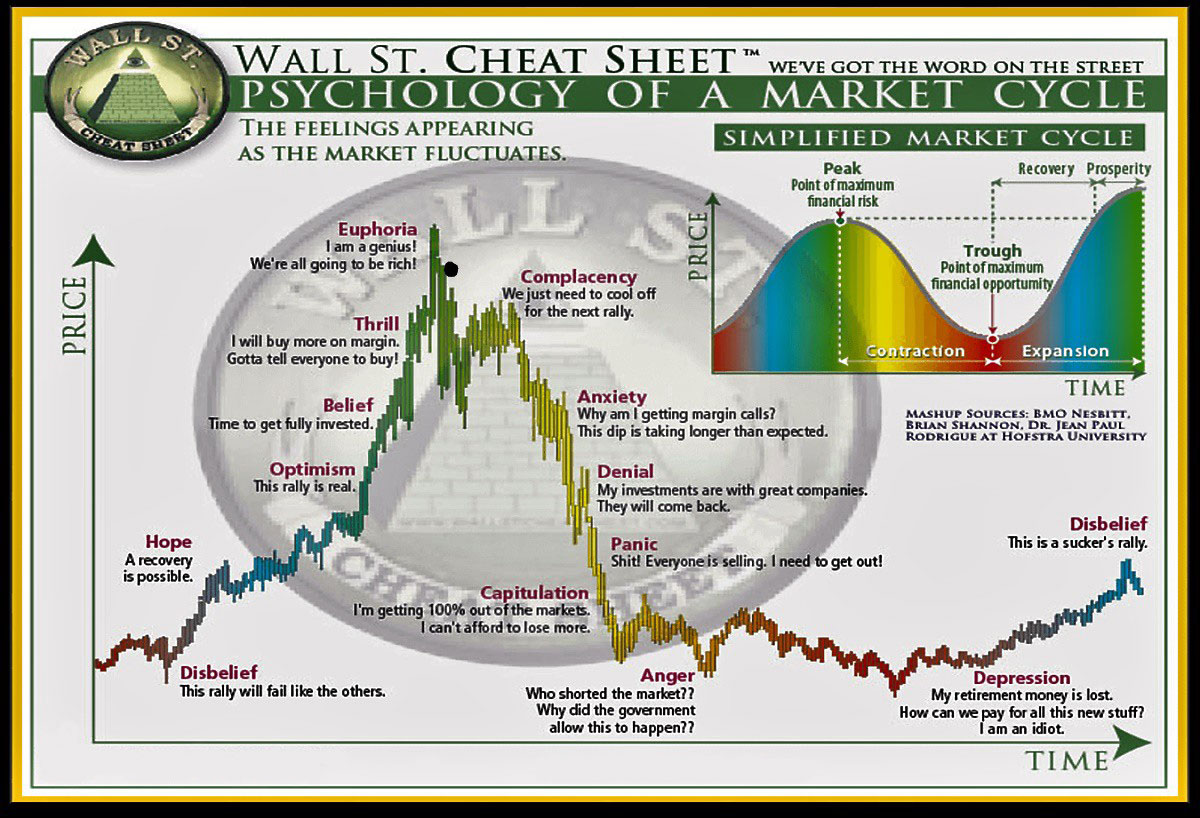

References

Wall Street Cheat Sheet

Wall Street Cheat Sheet

- Investor emotion cycle, Modern Times Investors

- The psychology of a bear market, Michael Batnick